Ex-financial TV analyst who became a fugitive arrested for fraud in Washington

Jun 19, 2024, 2:29 PM | Updated: 2:47 pm

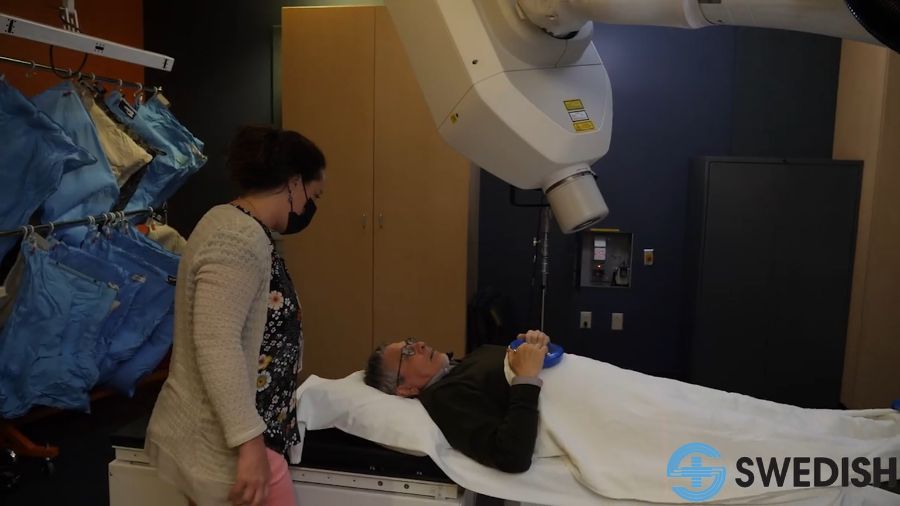

Former financial TV analyst James Arthur McDonald, Jr. was arrested at a residence in Port Orchard on Saturday, June 15, 2024. He faces multiple fraud charges. (Photos courtesy of the FBI/fbi.gov)

(Photos courtesy of the FBI/fbi.gov)

A former CEO of two investment firms who was a financial TV analyst on a cable network’s programs and later became a fugitive after being accused of defrauding investors has been arrested, the Offices of the United States Attorneys reported Monday.

James Arthur McDonald Jr., 52, was arrested last Saturday at a residence in the city of Port Orchard in Kitsap County, according to a news release from according to the United States Attorney’s Office in the Central District of California.

McDonald appeared Monday in United States District Court in Tacoma, CNBC reported. He was ordered held without bail Monday by a Tacoma judge, who ruled the defendant was a flight risk. McDonald agreed to be transferred from the state of Washington to California within weeks to face federal charges.

McDonald had been considered a fugitive since at least November 2021, after he failed to appear before the United States Securities and Exchange Commission (SEC) to testify after allegations arose he had defrauded investors. The agency stated in its release McDonald appeared to have terminated his previous phone and email accounts and told one person that he planned to “vanish.”

A federal grand jury in Los Angeles in January 2023 returned a seven-count indictment against McDonald, the U.S. Attorneys said. He has been charged with the following crimes:

- One count of securities fraud

- One count of wire fraud

- Three counts of investment adviser fraud

- Two counts of engaging in monetary transactions in property derived from unlawful activity

Later in its release, the agency added that on April 21, a judge found McDonald liable for a total of over $3.8 million, which represented the profits he gained due to his alleged conduct.

Fraud ring: Leader of scheme related to pandemic sentenced to five years

McDonald frequently appeared as an analyst on CNBC, the cable news network that provides business news and real-time financial market coverage and business content, its website states. In its coverage of McDonald’s arrest, CNBC noted he appeared as a “paid contributor” on the network. A 2022 affidavit from an FBI agent seeking McDonald’s arrest acquired by CNBC states McDonald “appeared on CNBC programs several times in late 2020 and in 2021 …”

The statement from the U.S. Attorneys says if McDonald gets convicted of all charges, he would face a statutory maximum sentence of 20 years in federal prison for each securities fraud and wire fraud count, up to 10 years in federal prison on the monetary transactions derived from unlawful activity count, and up to five years in federal prison on the investment adviser fraud count.

Looking at McDonald’s last several years

According to the indictment, McDonald was the CEO and chief investment officer of two companies: Hercules Investments LLC, based in Los Angeles, and Index Strategy Advisors Inc. (ISA), based in Redondo Beach, California.

The U.S. attorneys explained McDonald’s troubles began in 2020 during the height of the COVID-19 pandemic when he made some risky investments and lost clients a significant amount of money.

“In late 2020, McDonald lost tens of millions of dollars of Hercules client money after adopting a risky short position that effectively bet against the health of the United States economy in the aftermath of the U.S. presidential election,” the release states. “McDonald projected that the COVID-19 pandemic and the election would result in major selloffs that would cause the stock market to drop. When the market decline didn’t occur, Hercules clients lost between $30 million and $40 million. By December 2020, Hercules clients were complaining to company employees about the losses in their accounts.”

Since McDonald’s compensation for his investment advisory services primarily was based on a percentage of assets under his management, the losses to Hercules clients meant the fees McDonald was entitled to collect dropped significantly, the agency explained.

Drama in Minnesota: After attempted bribe, jury reaches verdict in case of 7 accused of pandemic-era fraud

Then in early 2021, after losing millions of dollars for his Hercules clients, McDonald solicited millions of dollars’ worth of funds from investors for Hercules but allegedly misrepresented how the funds would be used and failed to disclose the massive losses Hercules previously sustained.

McDonald – a major football fan – said he planned to launch a mutual fund under the ticker symbol “NFLHX.” The losses to Hercules clients and the potential for litigation related to those losses jeopardized the success of that fund because any litigation would have had to be publicly disclosed, the agency said.

The U.S. Attorneys stated that in one case, McDonald obtained $675,000 in investment funds from one victim group in March 2021, and he allegedly misappropriated those funds in various ways, including spending money at a Porsche dealership and at a website that sells designer menswear, court documents state. In addition, nearly $110,000 was transferred to the landlord of a home McDonald was renting in Arcadia, California.

McDonald also allegedly sent clients of his firm ISA false account statements. One client who invested approximately $351,000 later needed the money to make a down payment on a home was informed by McDonald that much of the money had been lost. The investor never got his full investment back, according to the agency statement.

Steve Coogan is the lead editor of MyNorthwest. You can read more of his stories here. Follow Steve on X, or email him here.